Real Estate Investments

Equity Crowdfunding

Private Equity

Private Debt

Impact Investments

Alternative Investments

Our Marketplace Lending platform is tailored for the next generation of private credit and crowdfunding platforms, aiming to streamline capital raising and enhance the investor experience. It offers a wide range of features, including integrated KYC, an Investor Portal, seamless Payment processing, Contracting capabilities, and robust Loan Administration tools. These features collectively elevate the user experience, making it the ultimate choice for modern private credit and crowdfunding platforms.

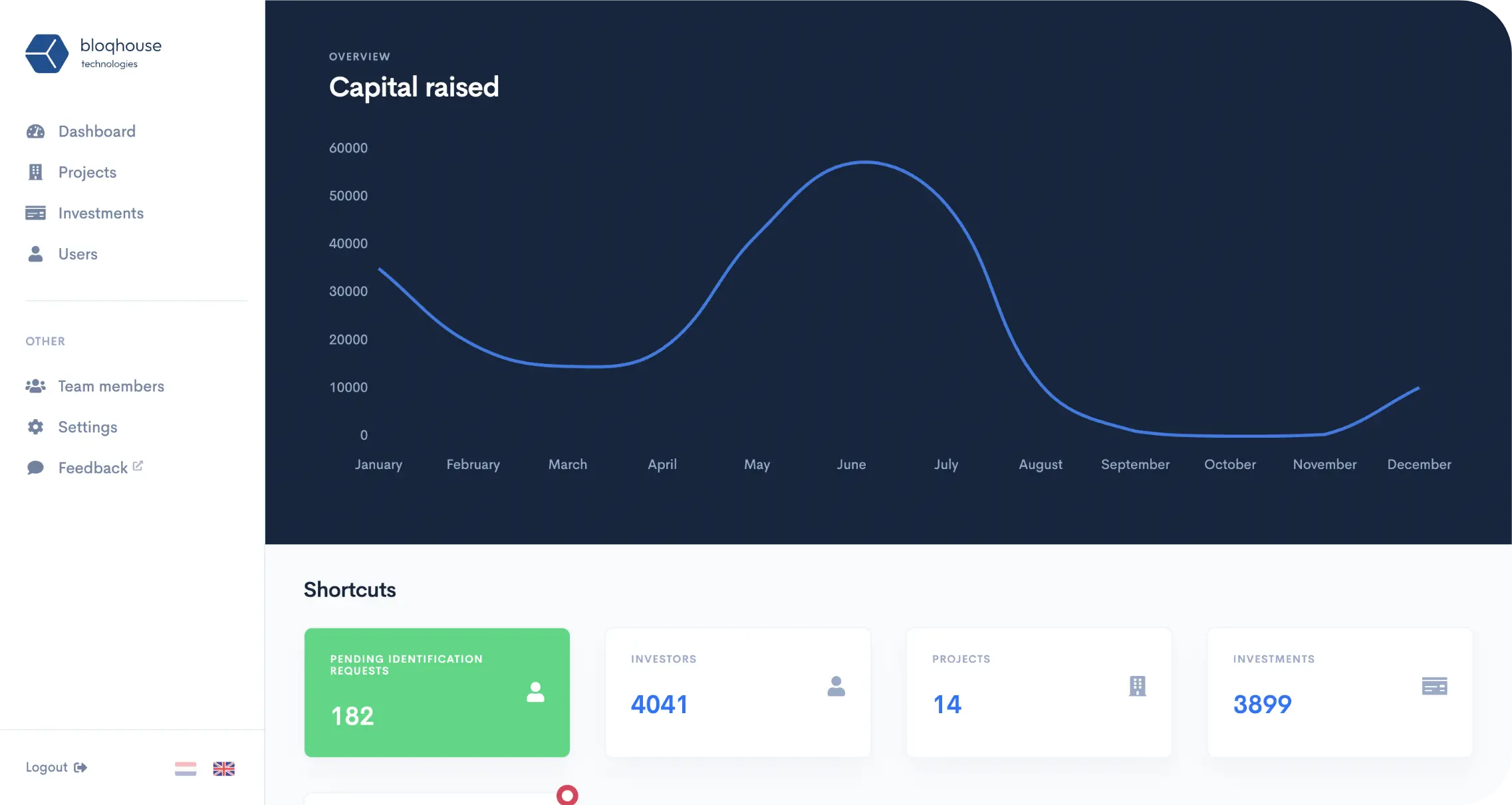

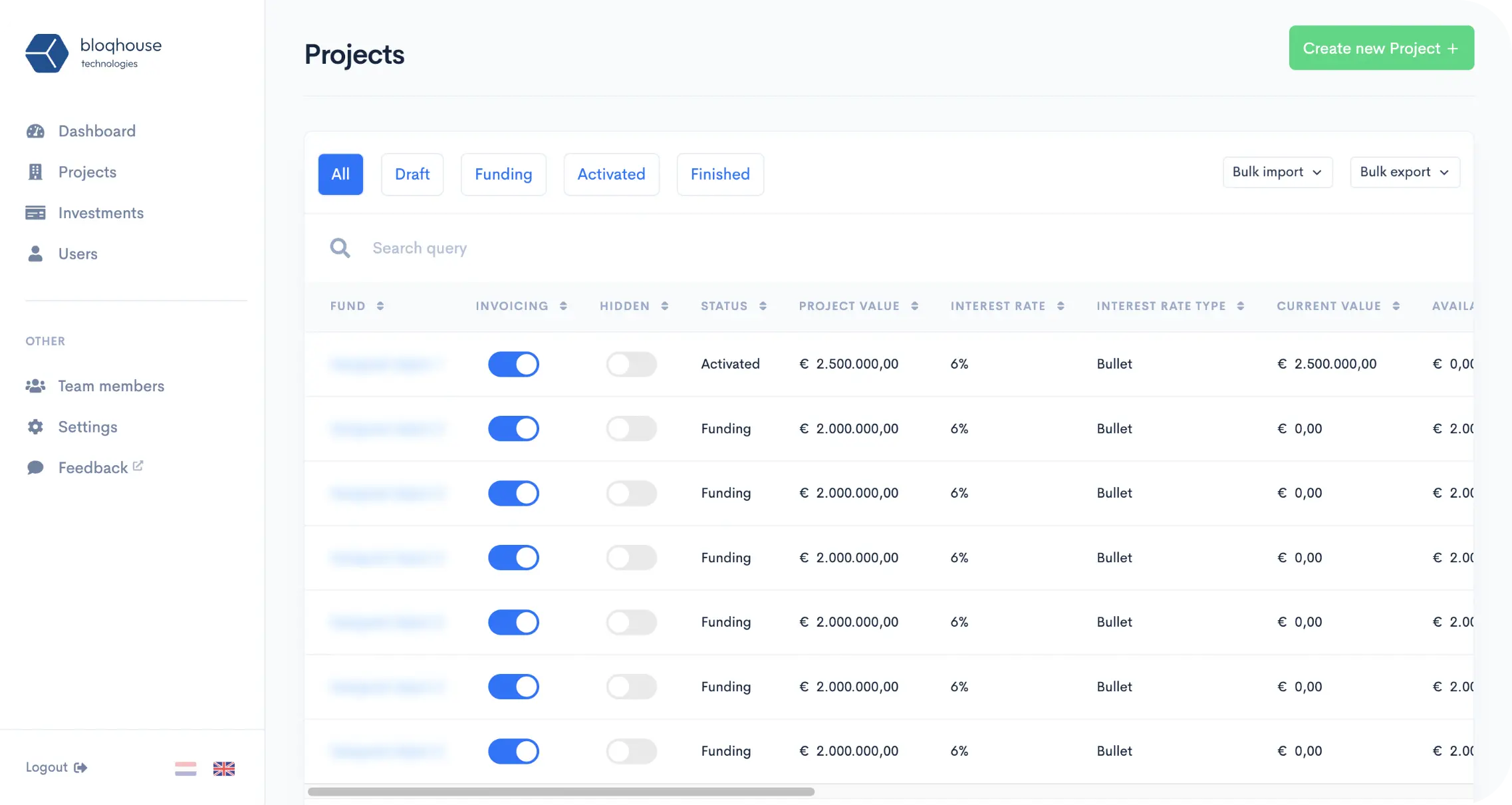

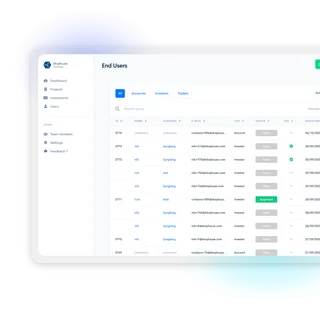

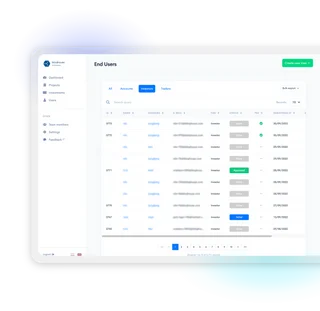

Admin Portal

The Admin Portal serves as a centralized control hub designed for system administrators to efficiently manage and oversee various aspects of the platform.

This comprehensive interface provides administrators with the tools and information needed to monitor system performance, user activity, and system configurations. From user management to system settings, the Admin Portal empowers administrators to make informed decisions and maintain the platform's integrity.

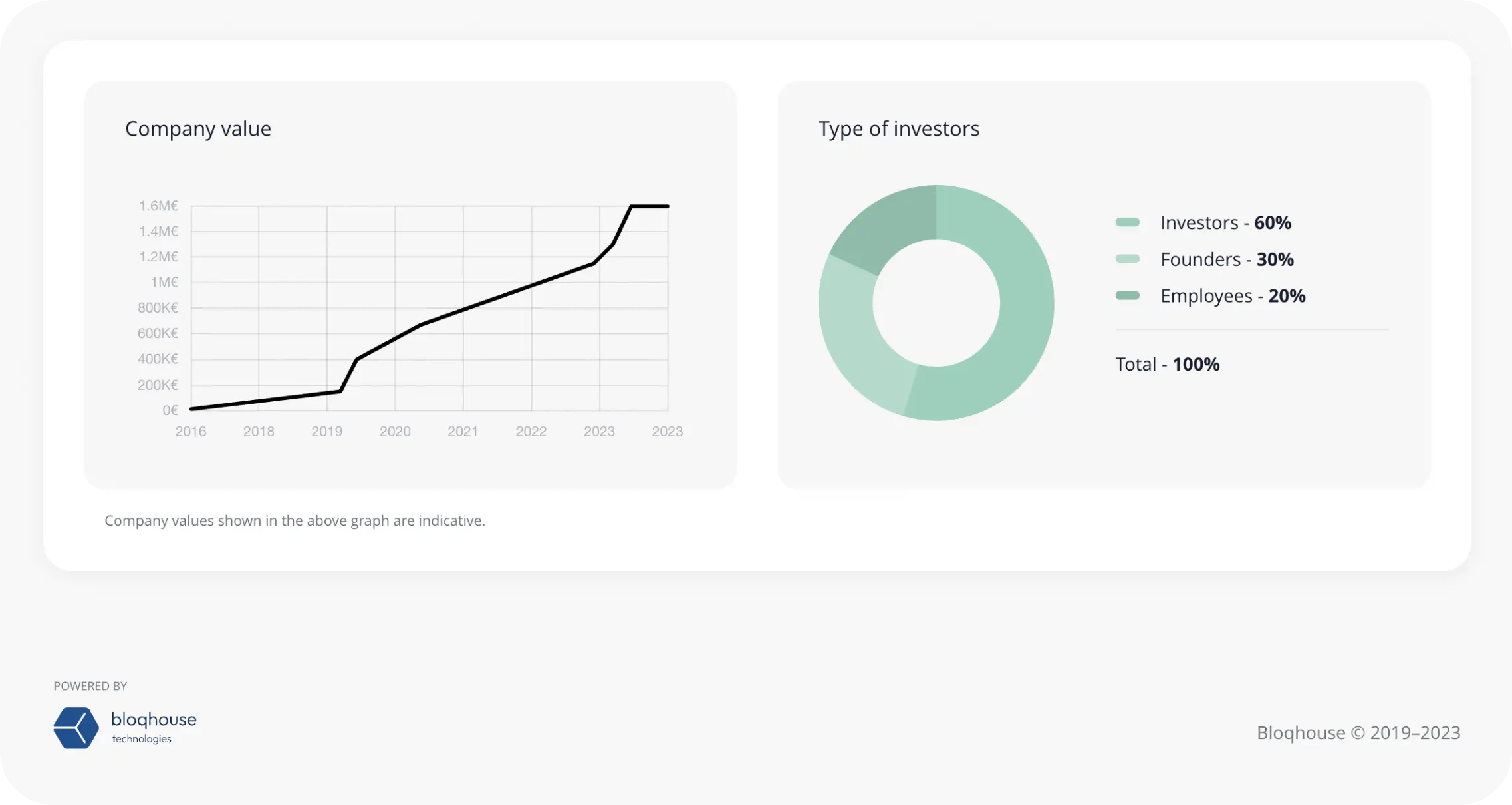

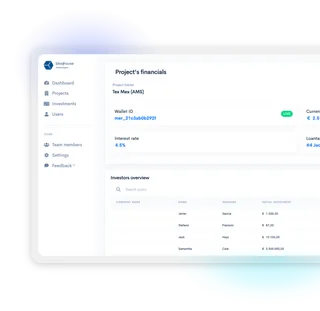

Investor Dashboard

The Investor Dashboard offers investors a user-friendly interface that provides real-time information and insights into their investments. Investors can access key metrics, performance data and documents allowing them to make informed decisions about their portfolios.

The intuitive design of the dashboard ensures a seamless user experience, enabling investors to track their investments and adjust their strategies as needed.

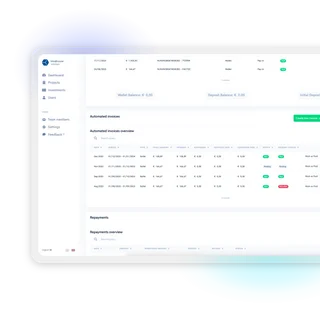

Automated Payments

The Automated Payments feature streamlines and automates payment processes within the system. This includes the capability to automate regular payments, such as interest payments, on a monthly, quarterly, or annual basis.

By automating these transactions, the system ensures accuracy, timeliness, and efficiency in handling financial transactions, enhancing overall user experience.

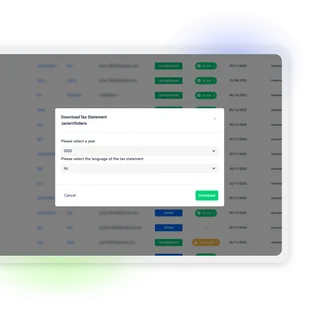

Automated Annual Reports

Automated Annual Reports are generated automatically to summarize annual financial and investment performance for tax purposes. These reports provide a comprehensive overview of key metrics, trends, and achievements over the course of the year.

Monitored Loans

The Monitored Loans tool enables tracking and management of loans, ensuring adherence to predefined criteria and standards. This feature provides a comprehensive overview of loan status, repayment schedules, and relevant metrics. With this tool, administrators can effectively monitor and manage the loan portfolio, minimizing risks and optimizing the lending process.

Investor Onboarding

Investor Onboarding is a guided process that assists new investors in registering and setting up their accounts. This streamlined procedure ensures a smooth and user-friendly experience for investors, reducing friction during the onboarding process.

Clear instructions and step-by-step guidance help new users complete the necessary steps to join the platform and start their investment journey.

Automated KYC

Automated Know Your Customer (KYC) verification enhances the onboarding process by streamlining identity verification for investors. This feature automates the collection and verification of necessary KYC information, ensuring compliance with regulatory requirements.

The automated KYC process expedites account approval, allowing investors to start using the platform more quickly.

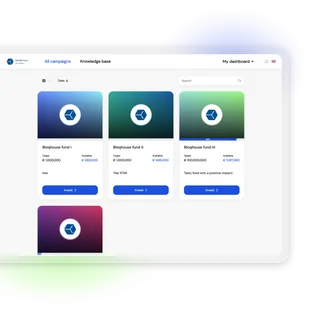

Online Marketplace

The Online Marketplace serves as a digital platform where various financial projects or investments can be bought and sold. This marketplace provides a secure and transparent environment for users to explore and engage with a diverse range of investment opportunities.

The user interface is designed to facilitate seamless transactions and enable users to make informed investment decisions.

Digital Contracts

Digital Contracts replace traditional paper contracts by offering an electronic platform for creating, signing, and storing contracts.

This feature enhances efficiency, reduces paperwork, and ensures the security of contractual agreements. The digital contract system includes features for electronic signatures, version control, and secure storage, contributing to a more streamlined and eco-friendly process.